Public Country by Country reporting

The European Parliament and the European Council issued the directive (EU) 2021/20101 on 24 November 2021.

It aims at increasing the transparency of what corporate income tax large undertakings pay in the different countries where they operate. This gives « citizens, investors and policymakers better insight into corporate behaviour ».

A restricted Country by Country reporting has already been in place for many years at the level of the OECD for large multinational enterprises.

With the new directive, the public Country by Country reporting (CbCR for short) has been made mandatory for more undertakings and branches. As a matter of fact, the directive foresees to include all undertakings having an annual income of more than 750 mio. € in a row and that operate in the European Union.

The European Commission issued the Implementing Regulation (EU) 2024/2952 on 29 November 2024 to exactly fix the content of the report.

In time for becoming effective on 23 December 2025, the European Commission published an XBRL taxonomy on 22 December 2025 together with a Reporting Manual and a report generator implemented as MS Excel macro worksheet to demonstrate how easy it is to generate the first report in iXBRL format.

Let’s discover Arevio CbCR Edition, our dedicated solution for undertakings, auditors, authorities & financial analysts

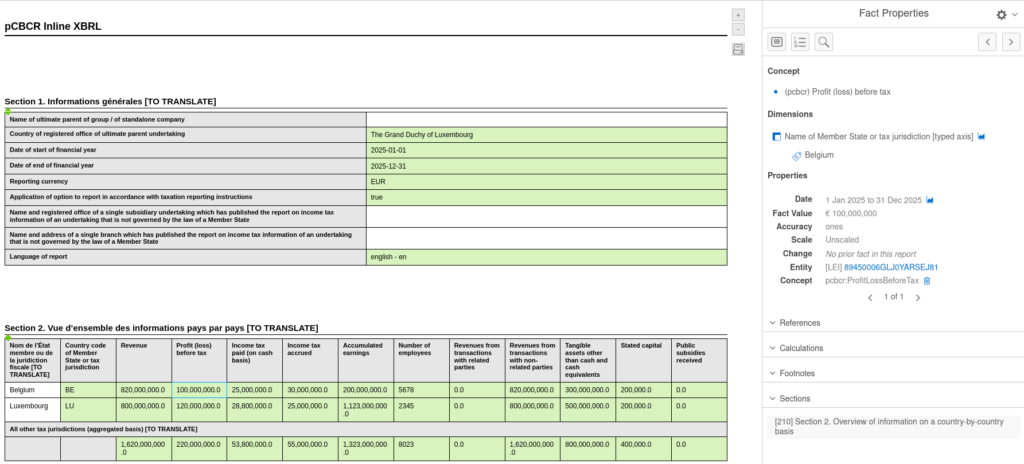

Review and analysis of CbCR iXBRL reports

Acsone provides an audit-minded and user-friendly tool for the control of CbCR reports; its name is Arevio CbCR Edition.

Arevio CbCR Edition takes care of providing all the mandatory pieces of information:

- Quantitative information related the income tax paid by country and aggregated,

- Narrative information within the text blocks,

- Failed CbCR control rules,

grouped within the so-called CbCR Control Report that could help auditors or authorities for their auditing mission. This report is available under two formats: Excel and JSON.

Excel file is appropriate for in depth analyses while JSON format is useful to upload reported information into Data Warehouse or Business Intelligent systems. In the later case, the audience can be expanded to financial analysts.

Choosing Arevio CbCR Edition also means acquiring the extensive support of a team of experts with a comprehensive knowledge of XBRL formats and CbCR requirements.

Creation and edition of CbCR iXBRL reports

Check our iXBRL page to see how undertakings can use Arevio CbCR Edition to create CbCR iXBRL reports from scratch or in conjunction with your ERP.

Arevio CbCR Edition fully checks the rules imposed by the European Commission Reporting Manual to make sure that the report submitted by the undertaking is fully compliant.

Moreover, Arevio CbCR Edition also generates a CbCR iXBRL report that complies with the layout given by the Implementing Regulation (EU) 2024/2952. The visual branding can be adapted to the marketing needs of the undertaking and to some extend supplemental text or images specific to the undertaking can be added.

Arevio CbCR Edition even handles gracefully the encoding of income tax disclosures that are omitted the first year and only disclosed within five years after their initial omission. They are added to the section 4 of the report in a tabular form similar to the tables of section 2!

Out of the box, the iXBRL reports are available in Dutch, English, French, German, Italian and Spanish (Castilian). Should you need a report in another language, do not hesitate to contact the Acsone XBRL team. Acsone is committed to supply a report in any official language of the European Union within a very short time (a few days).